canlegal

Online Credit Application

Our Online Credit Application is a fully customizable, secure, and efficient digital solution that transforms your traditional PDF or online PDF credit application into an interactive online experience – in both English and French.

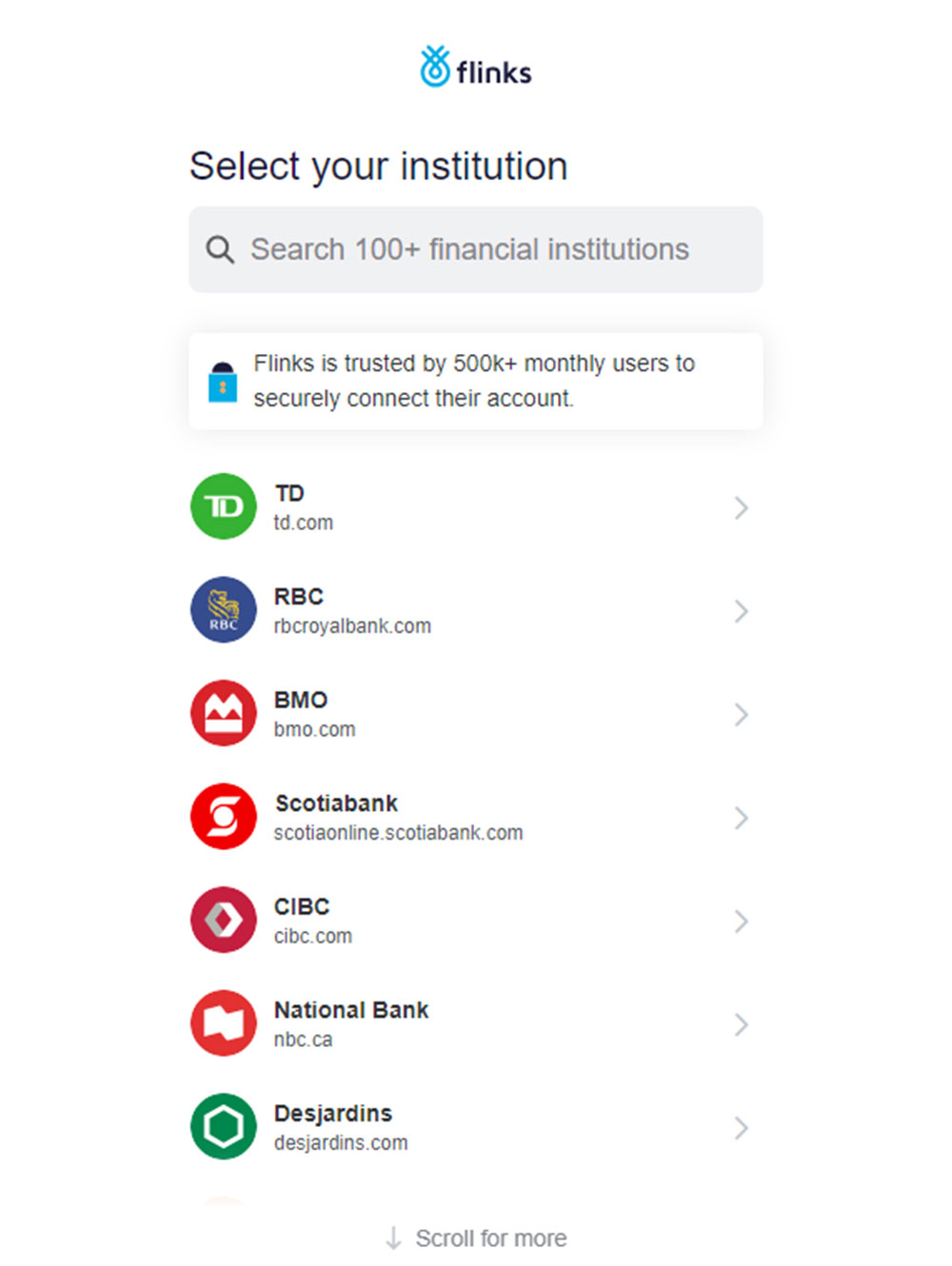

With built-in same-day credit check capabilities powered by Flinks, your customers can instantly and securely share financial data, helping you accelerate credit approvals effortlessly.

See a live sample of our Online Credit Application: www.canlegal.net/credit-app

Key Features & Benefits

• Fully Customizable: We replicate your existing credit application exactly - including your branding, fields, and terms & conditions - in both English and French

• Accurate & Error-Free: Mandatory fields, guided prompts, and typed entries eliminate mistakes and incomplete forms.

• No Printing or Scanning: Customers can upload their manual signature directly within the application, saving time and reducing hassle for both your team and customers.

• Accessible from Anywhere: The credit application can be completed online from any device - including smartphones and tablets.

• Secure & Tamper-Proof: Credit applications are delivered via a private link, submissions are tagged with IP and geolocation, and include a legally valid digital signature.

• Streamlined Processing: Completed credit applications are automatically converted into PDF format and sent directly to your email. All submissions are securely stored in a centralized online portal. Option to auto-forward to Canlegal for immediate credit reporting.

• Rapid Verification (Same-Day Credit Check): Through integration with Flinks, applicants can securely connect to their bank to share real-time financial data — enabling faster, more informed credit decisions.

Why It Matters

· Confident Credit Decisions: Required fields and verification features ensure you know exactly who you’re extending credit to.

· Professional & User-Friendly: Delivers a clean, branded experience that’s easy for your customers to complete - no printing, no scanning, or confusion.

· Faster Approvals: Automation and real-time financial verification dramatically reduce turnaround times and manual follow-ups.

Our Online Credit Application brings modern efficiency to your credit approval process - without disrupting your current workflow.